PayPlus Card UAE Complete Guide for Employees and Employers 2026

PayPlus Card has emerged as one of the best devices for both employers and employees within the United Arab Emirates (UAE). It’s a card for payroll created to ease the process of paying salaries and provide quick access to cash, as well as ensure that they are in conformance with the UAE Wages Protection Systems (WPS). It doesn’t matter if you’re salaried or an employer who manages payroll. Understanding PayPlus Card’s features, PayPlus Card can save time while reducing hassle and enhance managing your money. This article explains all that you need to be aware of regarding the PayPlus Card. PayPlus Card, including its functions, the methods of checking your balance and fees, tips for security, and the most common concerns.

What is the PayPlus Card?

PayPlus Card can be described as a pre-paid Payroll card offered through Al Ansari Exchange in the UAE. It’s linked to the salaries of employees and lets them gain access to their money without having to establish a bank account. Contrary to traditional debit cards, the PayPlus Card is a unique one. PayPlus Card is designed specifically for the disbursement of salaries, making it a safe and legal alternative in the WPS.

Key Features of the PayPlus Card

- Employers with easy access to their salary can cash out at ATMs in the UAE and then check their salary balance online, or by downloading an app for mobile devices.

- Secure Payments Card – This card is secured by a PIN, OTP, and two-factor security to authenticate transactions.

- Contactless Payments: Pay in store or online, without the hassle of handling cash.

- Access to mobile and Web Access – Monitor your balance as well as transaction history with applications or web-based portals.

- SMS as well as USSD Alerts – Keep informed with the latest transactions and balances available.

This PayPlus Card is especially useful for temporary and expatriate workers, as well as anyone with no regular UAE banking account.

Who Should Use a PayPlus Card?

For Employees

- People working in the construction, hospitality, retail, and logistics sectors.

- Expats who require security and quick access to their salary.

- People who want to use digital payment instead of cash handling.

For Employers

- Employers are looking to improve their payroll control.

- All businesses are required to be in compliance with the requirements of the UAE Wages Protection System (WPS).

- Finance and HR teams are looking to streamline their paperwork while improving efficiency and transparency.

How to Apply for a PayPlus Card

Application Process for Employers

Employers may issue PayPlus cards for their employees by following these instructions:

- Check out every Al Ansari branch or official site.

- Submit a trade license, a valid signature, an Emirates ID, as well as WPS identification documents.

- Sign a contract for payroll and give the employee’s details to issue the card.

Application Process for Employees

- You can get your PayPlus Card from your employer.

- It can be activated using your mobile app, the web portal, or via customer support.

- Enter your PIN as well as the credentials to your account online.

After activation, employees are able to get their wages and keep track of their transactions instantly.

How to Check PayPlus Card Balance

Being aware of the balance of your PayPlus Card is essential for managing your money effectively. There are many methods to accomplish this:

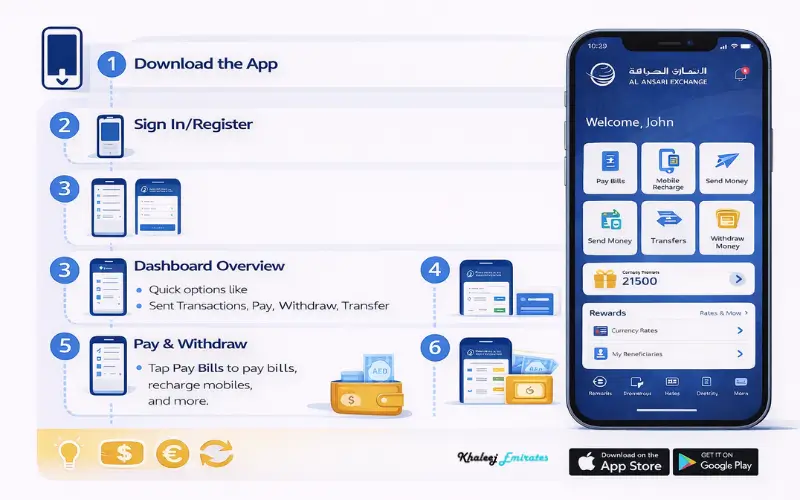

1. Mobile App

- Install this official PayPlus mobile application on iOS and Android.

- Log in with your credit card number and password.

- Review your balance, transaction records, and any pending credit.

- It is available 24/7, which makes it ideal for workers who are on the move.

2. Online Portal

- Log on to the PayPlus website with passwords that are secure passwords.

- Find your balance, current, and free balance.

- Manage multiple transactions, create statements, and set up the card’s settings.

3. ATM Balance Inquiry

- Make use of any ATM in the UAE to check your balance.

- Insert the PayPlus Card, enter your PIN, and then select the option to inquire about your balance.

- Take note that charges may apply to ATMs located outside those within the Al Ansari network.

4. SMS & USSD Balance Check

- An easy and non-interactive way to update your balance.

- Make sure you send a pre-defined SMS (or USSD code to receive immediate account balance alerts.

Understanding PayPlus Card Balance

Available vs Current Balance

- The balance available is the amount that you can use immediately.

- Current balance: Covers the pending transactions that have not yet been completed.

This distinction is important to avoid overdrafts or declined transactions.

Benefits of Regular Balance Checks

- Keep track of your spending routines.

- Detect the possibility of fraudulent transactions in advance.

- Savings and emergency funds can be planned efficiently.

- Beware of surprises when withdrawing money or purchase.

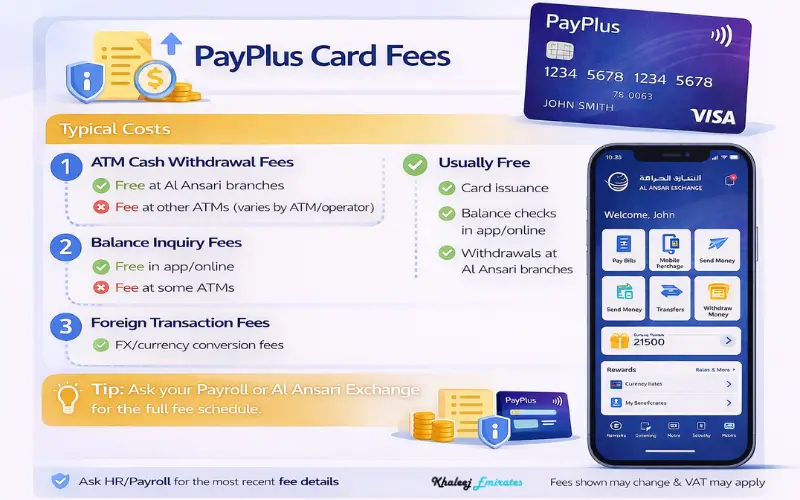

PayPlus Card fees

Knowing about fees will ensure the most efficient use of your credit or debit card.

Card Issuance and Annual Fees

- Some cards may charge issuance or annual costs based on the card’s employer and Al Ansari promotions.

- Occasionally, cards are offered free for corporate contracts.

Transaction Fees

- ATM withdrawals made outside of the network could incur fees.

- SMS and USSD alerts can have minimal costs.

- The majority of online transactions are completely free.

Optional Services Fees

- Reset your PIN for a small cost. Might be required.

- Replacement of cards: Charges for damaged or lost cards.

- SMS notifications and other services can also come with some costs.

Security Tips for PayPlus Card Users

The security of your credit card is essential:

- Make sure to use secure connections and devices that are trusted.

- Do not divulge details of your PIN, OTP, and card information.

- Allow transaction notification.

- Sign out of applications or portals at the end of each session.

- Be wary of emails that are phishing or fake sites.

Common Issues and Solutions

- Forgot your login details – reset through the portal, or call support.

- Mobile app issues – either update your app or clear the cache.

- ATM issues – Look for an ATM nearby Al Ansari ATM.

- If your card is stolen or lost, call Al Ansari support immediately.

These measures ensure speedy resolution as well as reducing financial risks.

Must visit: FAB Balance Check

PayPlus Card for Businesses

PayPlus isn’t just for employees; it also benefits employers greatly:

- Payroll management that is efficient for multiple employees.

- In compliance with the UAE, the WPS System.

- This reduces the administrative burden as well as the chance of making mistakes manually.

- Provides tools to report on the Finance and HR departments.

Through the use of PayPlus, businesses can be assured of prompt, safe, and clear salary distribution.

Tracking International Transfers via PayPlus Card

To send money to foreign countries for expatriates:

- Connect the PayPlus Card to international remittance services.

- Track transfers of funds at any time using the app or on the web portal.

- Profit from exchange rates that are competitive as well as low fees for remittances.

This is what allows this PayPlus Card to be a powerful financial instrument for UAE people who work abroad, and also for those who wish to send money to their families.

Customer Support for PayPlus Card

Al Ansari offers robust customer assistance to PayPlus customers:

- Support via email, phone, live chat Branch assistance.

- Operational hours for quick query resolution.

- A speedy handling of lost credit cards, transactions that are not correct, and account set-up.

Tips: Make sure to keep ep contact numbers of customer service in case you need to contact them promptly in case of urgent needs.

Rewards, Promotions, and Benefits

- Certain PayPlus cards also offer cashback or discounts for customers.

- Integration with Al Ansari loyalty and reward points.

- Promos for frequent ATM withdrawals and online transactions.

The benefits of these cards increase the value when making use of the PayPlus Card in the UAE.

Conclusion

It is the PayPlus Card is a safe, easy, efficient, and compliant payroll solution for both employees and employers working in the UAE. It allows quick access to salaries and reduces the burden of administration for companies, and offers the security of financial transactions for employees, particularly expatriates. With the help of the mobile application or portal, as well as ATMs, employees are able to manage their salaries efficiently. In turn, employers enjoy a simplified process for payment compliance through the Wages Protection System of the UAE (WPS).

Regular checks of balances, understanding of the fees, and adhering in accordance to the security best practices ensure that both business and employees reap the advantages of PayPlus. Offering rewards, discounts, and transfer options to foreign countries and international transfers, PayPlus is a great choice for international transfers. PayPlus Card continues to be the preferred option for managing finances until 2026.

FAQs

1. What is a PayPlus Card?

A payroll card that is prepaid to use to receive wages and make payments within the UAE.

2. Who can get a PayPlus Card?

Workers of companies that comply with WPS throughout the UAE.

3. What can I do to check the balance of my PayPlus Card?

Utilizing the mobile app via the mobile app, web portal, SMS, USSD, or Al Ansari ATMs.

4. Can employers use it to pay payment of wages?

It automates wage payment as well as WPS conformity.

5. Do you have any additional charges on the card?

There are no fees to pay for ATM withdrawals, replacement cards, or SMS alerts. Balance checks on the internet are typically absolutely free.

6. Pay online using a PayPlus Card?

Yes, it is compatible with payment via online or in-store.

7. What happens if my credit card gets damaged or lost?

Get in touch with Al Ansari support to block and immediately replace the card.

8. How do I get the PayPlus Card? PayPlus Card?

You can activate the app on your mobile either online or in the Al Ansari branch.

9. Do I have the ability to send money abroad?

Yes, some remittance providers permit international transfer.

10. How can I receive notification of transactions?

You can enable SMS or emails to notify you via the app or via a portal.