FAB Balance Check – Easy Ways to Monitor Your Account

Checking the status of your FAB (First Abu Dhabi Bank) balance on your account is an essential part of being able to manage your finances efficiently. No matter if you’ve got an account for savings, an existing account, a credit card, or a fixed deposit, understanding the amount of money you have left helps keep track of your expenses, avoid overdrafts, and budget effectively. FAB is one of the most important banks within FAB, which is one of the largest banks in the UAE FAB offers a broad range of products and services to companies and individuals alike that making it easier to keep track of your finances.

In the age of online banking, FAB gives you several easy ways to check the balance of your account securely. The online banking app, mobile apps, ATMs, SMS notifications, and customer service for access to your account funds fast and safely. They are made to be quick, secure, and simple to use. They will ensure that you can have instant access to your balance at any time and from anywhere. This gives you peace of mind as well as better control of your finances.

Methods to FAB Balance Check

The process of keeping track of your FAB, checking your balance on the account, is quick and easy. FAB provides a variety of ways to monitor your balance; therefore, you are able to choose the option that best suits your needs.

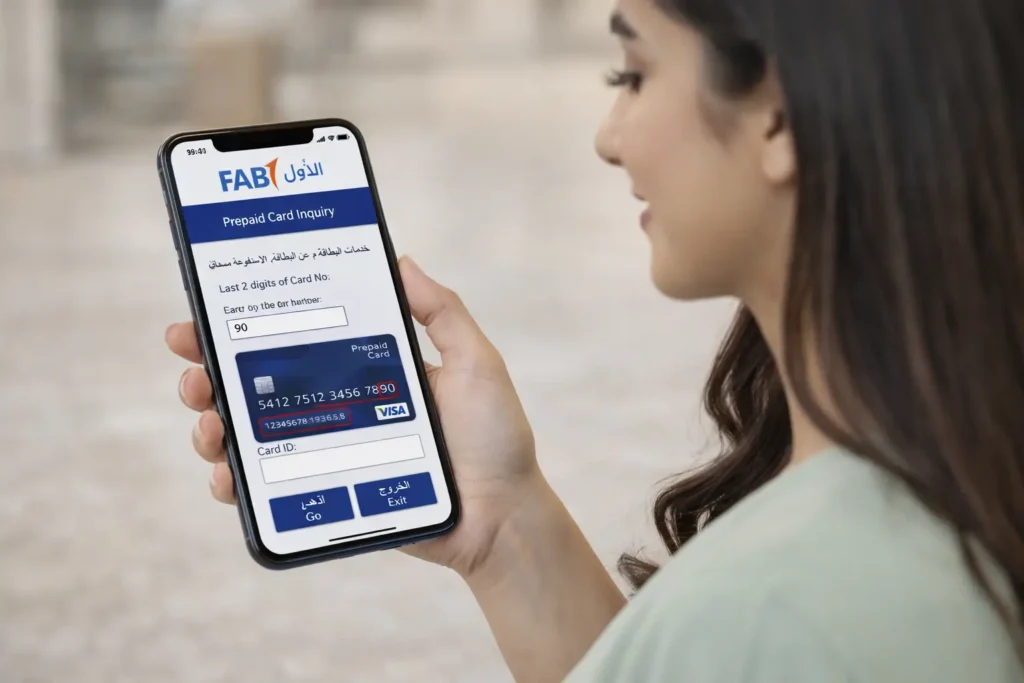

1. FAB Mobile App

The FAB mobile application is the quickest and easiest method to monitor the balance of your account anytime and from any location.

The best way to verify the balance is using the application:

- Install the FAB mobile application from your application store.

- Log in using the username and password, as well as an OTP, to protect yourself.

- Visit the section Accounts for your current account balance, your ledger balance, and the most recent transactions.

Features you can enjoy:

- Take a look at a small statement immediately.

- Get alerts on transactions to keep informed.

- Transfer funds effortlessly across accounts.

- Fingerprint authentication is secure using biometrics or facial recognition.

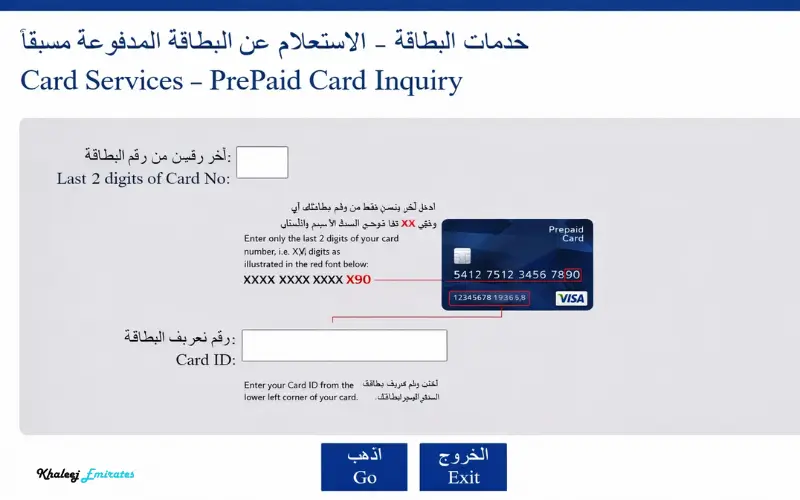

2. FAB Internet Banking

If you would rather use an internet browser or computer online, FAB Internet Banking is a suitable option.

How to check your balance on the internet:

- Go to the FAB online banking site.

- Log in to your account using your username as well as your OTP.

- Click on your account Summary to review the balance of your ledger, its current balance, and transactions.

Internet banking is ideal for those who want the ability to see a complete overview of their accounts, which includes statements and transfers of funds.

3. FAB ATM Balance Check

FAB ATMs are available all over the UAE and offer rapid check of balances.

Checking balances at the ATM:

- Insert your FAB debit or credit card.

- Make sure you enter your PIN in a secure manner.

- Select Balance Inquiry or Mini Statement.

- Check your balance online or print it out if you need to.

Utilizing ATMs can provide quick access to the internet without any connection, even during your travels.

Must Visit: How FAB ATM Balance Check

4. FAB SMS Banking

For those who want simple and quick ways to bank, FAB provides SMS banking.

How does it work:

- Enter your mobile number into FAB to enable SMS service.

- Make sure you send a particular number (like “BAL”) to the FAB short code.

- Check your account balance in real time via SMS.

This solution is perfect for those who do not have phones or access to the internet.

5. Customer Care / Call Center

If you encounter any difficulties regarding ATMs or apps, FAB customer care can assist you in checking the balance.

Steps:

- Make a call to the FAB customer support phone number.

- Check your identity using your account information.

- Request the representative to provide your current balance in the account or any recent transactions.

Support from the customer care department is beneficial to resolve issues fast and receive personalized assistance.

Different FAB Account Types

Savings Account

FAB Savings accounts are created specifically for people who would like to build their savings and have easy access to money. The balance checking of savings accounts is possible via mobile banking, online banking, or ATMs. A lot of customers like the FAB Mobile app notifications, which notify them of transactions and their balances in real-time.

Current Account

Current accounts are great for small businesses and individuals who require regular transactions. The ability to check balances of an account that is current ensures it is possible to control business expenses or personal expenditures quickly. FAB offers a variety of digital and offline options to keep track of the balances of your current balance.

Credit & Debit Cards

A credit or debit card has two kinds of balances: a ledger balance (the amount of money that is on the account) as well as the balance available (the amount that you are able to spend). The ability to check your balance using the FAB mobile application or via SMS banking can help you keep your spending under control and ensure that you are always able to access the required money.

Fixed Deposits

Even though fixed deposits are intended to provide long-term savings, you can keep track of your deposit’s amount, maturation date, as well as accrued interest through FAB’s online banking and the mobile application. In addition, you will receive a notification when the deposit is due to mature or when interest credits are made.

Security Tips While Checking FAB Balance

Secure your OTP, PIN, and login credentials in a safe place

Your PIN, as well as your OTP (One-Time Password), as your online bank account credentials online will allow you to log into an FAB bank account. Do not share them with anyone, and be careful about keeping them in accessible locations like phone notes or in emails. Secure information ensures that only you have access to your account. It also stops unauthorized transactions.

Two-factor authentication is a must for online banking

Two-factor authentication provides an additional layer of protection by requiring an additional verification process that includes an OTP delivered via your mobile number registered with the company, as well as your password. This feature can make the process much more difficult for criminals to gain access to your account, even if they do manage to obtain the login information.

Do not check balances on Wi-Fi networks in public

Wireless networks that are public, such as the ones found in cafes, airports, ports, and hotels, tend to be less secure and could be used by hackers to steal banking data. Always choose a secure connection or mobile phone to access your FAB account, to help keep your bank account information secure.

Be sure to monitor your transactions regularly for suspicious transactions

Despite all the security measures put in place, it’s essential to check your bank account’s activities regularly. Review your balance, the most recent transactions, and any alerts to confirm that there are no unauthorized charges. The early identification of suspicious transactions lets you report any concerns promptly to FAB customer service, thus reducing any financial risk.

Benefits of Regular Balance Checks

1. Beware of overdrafts

Monitoring the FAB balance allows you to keep track of the amount of funds you’ve available and prevents you from using over what your account can handle. You can avoid any charges for overdrafts or rejected transactions and keep your money under control.

2. Keep track of your spending patterns

Checking your balance regularly helps you evaluate the expenses you incur each month. When you understand the whereabouts of your cash it is possible to make educated decisions regarding your spending habits and cut down on unnecessary expenditures, and remain within the limits of your budget.

3. Security of the account

Monitoring your balance regularly helps you identify any unauthorised or suspicious transactions before they become a problem. It also allows you to notify FAB promptly, securing your account from fraudulent transactions or abuse.

4. Financial planning

Monitoring your account balance is a crucial aspect of a successful financial plan. This helps you control your expenses as well as plan your savings and take smart decisions about investment,s and ensures you achieve the short and long-term financial targets.

Troubleshooting Common Issues

- If you are not receiving alerts via SMS, make sure your mobile number is correct in your registration.

- Problems with login to the app: Upgrade the app, or change your password.

- Problems with ATMs: Choose an alternative FAB ATM, or call the customer service.

- Balance is not updated. If your balance is not updating, contact FAB support for the real-time resolution.

Conclusion

The ability to FAB balance check on your account is now easier than ever before. No matter if you are using mobile apps or internet banking, ATMs and SMS services, or assistance from a customer service representative, FAB ensures you have immediate access to your account funds. Checking your balance regularly will not only aid in tracking your spending and prevent overdrafts, they ensure that your account is safe. If you follow security guidelines and using online banking tools, securing your money in the UAE is easy and secure.

Must visit:

How to Unlink FAB Mobile App Safely and Easily

Sharjah Parking Timing

Questions about FAB Balance Check and Answers

How can I find my FAB balance using my smartphone?

Check your balance with the FAB mobile application by signing into the app using your login credentials and going to the Accounts section.

How can I verify my FAB balance on the internet?

Yes, you can make use of SMS banking, or go to an ATM for checking your account balance even without access to the internet.

What’s the most efficient method to determine the FAB balance?

The FAB mobile application is the most efficient and efficient method to receive live balance updates in real time.

Where can I find my current balance on my FAB credit card?

Log in to FAB via the FAB mobile application or online banking, and the available as well as outstanding balance on your credit card will be shown.

How can I check the balance of my FAB account via SMS?

You can make sure you register your mobile number to receive SMS alerts. Then, send the balance number (e.g., “BAL”) to the short code, and be notified of your balance in real time.

What can I do to check my balance on FAB at an ATM?

Insert your FAB card, type in your PIN, choose the Balance Inquiry option, or Mini Statement. View the balance of your account online or print it.

Can I safely check FAB balances on Wi-Fi in public areas?

Public Wi-Fi is not a good idea, and can be a risk. Make sure to use reliable networks and mobile data in order to keep your financial information secure.

What is the best way to set up Balance alerts for the FAB mobile application?

Launch the FAB app, then go to Alerts or Notifications, then enable balance and transaction alerts so that you can receive notifications immediately.

What’s the main difference between the available balance and the ledger Balance in the FAB?

Balance available refers to the amount that you are able to spend in a single day, and the ledger balance is comprised of the pending transactions that have not been cleared.

How can I find my FAB account balance via the customer service?

Yes, contact FAB customer support, and verify your identity. The customer care representative will provide you with the current balance.

What is the best time to examine my FAB Balance in my FAB account?

It’s recommended to review your account balance regularly, usually every week or prior to making large payments, to help manage your money efficiently.

How can I activate two-factor authentication on FAB Internet Banking?

Log into FAB Internet Banking, then go into Security Settings, and enable two-factor authentication for additional security.

What do I do If I notice that my FAB balance isn’t updating?

Verify your connection to the internet, update the app or call FAB Customer Care to address any issues.

How can I view my FAB Fixed Deposit balance on the internet?

Yes, your fixed-deposit balance as well as the maturity date can be seen through the FAB mobile application or on the internet bank portal.

What can I do to monitor my expenditure using FAB Balance updates?

Set up alerts for transactions and periodic check of balances to monitor the patterns of your spending and help you manage your money effectively.