Al Ansari Balance Check UAE 2026 – Complete Guide

The process of checking the balance of your Al Ansari balance UAE has now become a crucial element of financial management, whether you’re employed and receiving your pay via the PayPlus card, or you are a company overseeing payroll for your employees. Al Ansari Exchange, one of the most trusted financial services companies within the UAE, provides a variety of ways to monitor your account and balance quickly, easily, safely, and securely. This article provides step-by-step guidelines as well as tips and insights regarding the process of checking the balance of your Al Ansari account, understanding costs, fixing common issues, using and safeguarding your information while making use of the service.

What is Al Ansari Exchange and the PayPlus Salary Card?

Overview of Al Ansari Exchange

Al Ansari Exchange is a company that provides financial services in the UAE, which is widely acclaimed as dependable and offering a wide variety of services. Since its inception, Al Ansari has become a popular choice for individuals and companies for currency exchange as well as remittance, payment of bills, as well as payroll solutions. It complies with Dubai’s Wages Protection System (WPS), which ensures the timely and secure payment of salaries to employees from the entire emirates.

Methods to Check Your Al Ansari Balance

Al Ansari provides multiple convenient ways to check balance that are suitable for both web-savvy users as well as users who prefer to use alternative methods.

1. Al Ansari Mobile App

The Al Ansari mobile app is the easiest way to monitor your balance. The app is compatible with both iOS as well as Android gadgets. The location offers real-time updates on balance, along with transaction information, as well as alerts on incoming and outgoing transactions.

Step-by-Step Guide:

- Install the Al Ansari app on the App Store. Or Google Play.

- Enter your personal information or card information.

- Sign in safely with a biometric or password authentication.

- Click on”Balance Inquiry” section “Balance Inquiry” section to see your available and current balance.

- You can also enable notifications to receive real-time alerts for transactions.

Benefits: Live updates on balance and secure login. Also, a detailed transaction history.

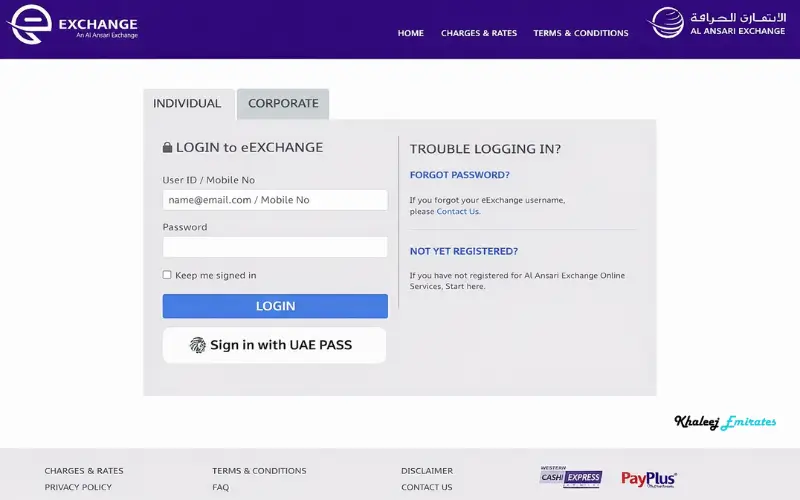

2. Online Portal

Its Al Ansari online portal is perfect for those who enjoy monitoring their account balances using tablets or computers. Account holders of both personal and corporate accounts can use the portal to manage their finances in a more detailed manner.

Step-by-Step Guide:

- Go to this website of the official Al Ansari website.

- Log in to your private or corporate account.

- Click on the “payment card” section or “PayPlus Card“, or “Account Summary” section.

- Verify your balance and current balance.

- Check out the transaction history for more insights.

Benefits: Complete account information and a secure HTTPS connection that is suitable for monitoring the payroll of a business.

3. ATM Balance Check

If you prefer to use offline methods, ATM balance checks are widely accessible all over the UAE. Al Ansari ATMs and partner ATMs offer easy access to balances of accounts as well as mini-statements.

Step-by-Step Guide:

- Insert your PayPlus card into an ATM.

- Securely enter your PIN.

- Click on”Balance Inquiry” or “Balance Inquiry” option.

- The machine shows the balance of your account and prints an invoice.

Benefits: instant access and works with no internet connection cost, and a minimal fee based on ATM use.

4. SMS and USSD Balance Check

Al Ansari provides a convenient method of checking your balance with no internet connection by using SMS as well as USSD codes.

Step-by-Step Guide:

- You can send the code required to the specified Al Ansari number.

- Get an instant text message response to your current balance.

- A few codes could include transaction data from the previous couple of days.

Benefits: It works without an internet connection, immediate response Easy to utilize.

5. PayPlus Card Portal

card PayPlus card comes with a separate site for employees and employers. It lets you track in real time the amount of salary credit, the history of transactions, and the balance.

Step-by-Step Guide:

- Go to the PayPlus Portal on the website of Al Ansari.

- Log in with your PayPlus card number as well as your password.

- See your current balance as well as the history of transactions.

- Download statements as an option to record the information.

Benefits: Real-time credit for salary updates, distinct employees and employer views, and detailed reports on transactions.

Fees and Charges for Balance Checks and PayPlus Card

While most Al Ansari services are cost-effective, certain fees may apply. It’s important to be aware of these charges to avoid unexpected deductions.

| Fee Type | Fee (AED) | Notes |

| Card Issuance | 20–30 | One-time fee |

| Annual Maintenance | 10–20 | Charged yearly |

| ATM Withdrawal (Non-network) | 2–5 per transaction | Fees may vary by ATM provider |

| Balance Inquiry (ATM/SMS) | 1–2 | Minimal fees for SMS or ATM usage |

| Card Replacement | 10–15 | Lost/stolen card replacement |

| PIN Reset | 5 | Securely reset via portal or app |

| SMS Notifications | 2–3/month | Optional real-time alerts |

Why Regular Balance Check is Important

Financial Awareness

Monitoring the balance of your account allows you to keep track of the spending patterns of your family, plan your budget for the month effectively, and reduce the risk of excessive spending. If you’re using the PayPlus card or your bank account that is linked with Al Ansari, regular balance check-ups provide visibility to your financial situation.

Security

Checking your balance regularly can help identify suspicious or fraudulent transactions. Quick action is a way to avoid loss of funds and also ensure the security of your accounts.

Business Benefits

Businesses that use Al Ansari payroll services, the balance checker allows employers to ensure that their salaries are properly credited to employee accounts. Additionally, it helps to ensure the compliance of WPS regulations and helps ensure the smooth running of payroll.

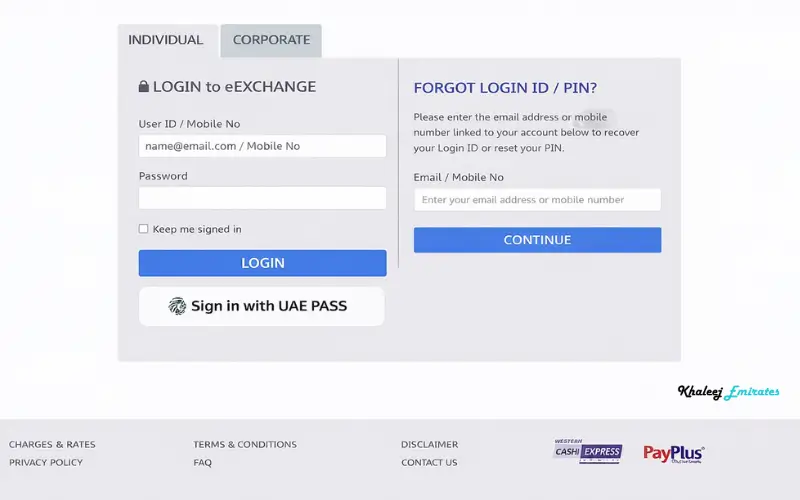

Common Issues While Checking Balance

Forgot Login or PIN

Many users forget their web login passwords or their PayPlus card PINs. Al Ansari provides a secure reset procedure through email, SMS, or a branch visit.

App Crashes or Server Downtime

At times, the mobile application or website might experience intermittent slowdowns. After a couple of minutes or reinstalling the app typically resolves the issue.

ATM Errors

Incorrect PIN entry or problems can limit access to your balance. Call customer service immediately when your credit card is not being used or when transactions stop.

How to Resolve Issues

- Make use of the “Forgot Password/PIN” option on the app or on the portal.

- Update or install the app for mobile devices.

- Find the nearest Al Ansari branch for assistance.

- Contact customer support in the event of urgent questions.

How to Contact Al Ansari Customer Support

Al Ansari Exchange offers multiple assistance channels for customers to solve issues as well as answer questions.

- Phone: +971-600-54-6000

Email: info@alansariexchange.com - Support in person at the branch: Go to any branch for assistance in person.

- Live Chat is available via the official website.

Tips: Using the phone during operating hours usually results in better resolution.

Security Tips for Safe Balance Checks

- Always make sure you use secure Wi-Fi or mobile data while conducting balance checks on the internet.

- Make sure to regularly update passwords, and stay away from the use of PINs that are simple.

- Set up notifications of real-time transactions.

- Don’t divulge your password, OTP, or login credentials.

- Beware of emails that are phishing or SMS fraud.

- Check out at the end of each session to stop unauthorized access.

Available vs Current Balance Explained

The distinction between the available and current balance can help avoid being a victim of overdrafts or declined transactions.

- Current Balance: reflects the balance of all accounts and includes any ongoing transactions.

- Available Balance: The funds can be used immediately after the completion of accounting for any of he pending transactions.

In this case, if, for example, you have a balance of AED 2,000, but AED 500 is in the midst of an unrelated transaction, your balance is AED 1,500.

Al Ansari Balance Check for Businesses

Employers who use Al Ansari’s payroll service can handle many employee accounts in a way that is efficient.

- Check that the salaries have been correctly recognized.

- Monitor corporate PayPlus card usage.

- Check for compliance to WPS guidelines.

- Download the reports to use for accounting or purpose of auditing.

This creates Al Ansari an ideal partner to businesses located in UAE needing effective payroll solutions.

Benefits of Using Al Ansari Services

- International Transfers: No charges and quick processing of money transfer.

- Charge Payments for Bills: You can pay your utility and mobile bills online through the app or portal.

- Rewards and promotions: Repeat users benefit from loyalty programs and promotions.

- Real-time Tracking: Track your transactions immediately via an apps, SMS or a web-based portal.

- Accessibility to the entire UAE. Available in every emirate with branches and ATMs that are convenient.

Conclusion

Making sure you have the balance of your Al Ansari balance in the UAE is never easier. No matter if you’re a person seeking to keep track of your expenditure or an organization that wants to ensure efficient payroll processes, Al Ansari offers multiple options to verify balances quickly, effectively, and easily. By using the PayPlus pay card, mobile app ATM, an online portal and SMS services that allow you to stay up-to-date with your financials. Regular check-ups on your balance, paired with secure methods, help assure that you handle your cash effectively and in a safe manner all over the UAE.

Related Blogs:

FAB Balance Check

How to Unlink FAB Mobile App Safely and Easily

How to Unlink FAB Mobile App Safely and Easily

FAQs

Where can I find the balance of my Al Ansari balance online?

Check your balance by visiting Al Ansari’s website of the official Al Ansari website or mobile application for updates in real-time.

Do I have the ability to check my balance online without Internet access?

Yes, you are able to check your balance via SMS, USSD codes, or through an ATM.

Do balance inquiries cost anything?

Balance checks that are made via the app or on the web portal are absolutely free. The ATM check or an SMS message might incur some small costs.

What can I do to change my PayPlus card’s PIN?

The reset option for your PIN is by using your Al Ansari portal, mobile application, or at the branch closest to you.

What’s the fastest method to verify the credit on your salary?

Mobile apps or SMS alerts you immediately whenever your earnings are credited.

What can I do to track the transfer of funds internationally?

It is possible to track transactions on the internet portal, the mobile app or by visiting a branch with the reference number for each transaction.

Does Al Ansari’s online portal secure? Al Ansari online portal secure?

Yes, this portal utilizes HTTPS encryption as well as multi-factor authentication to safeguard the data you store there.

What is the best way to use SMS as well as USSD to see my account balance?

The code you need to enter is the official Al Ansari number and you will be notified of your balance immediately.

What’s the distinction between available balance and balance at present?

Current balance comprises outstanding transactions. While the there is a balance available that which you have the ability to use in a matter of minutes.

Employers can view the employee’s PayPlus card balance?

Employers are able to view balances via the portal of their company to assist with pay verification.