Gratuity Calculator Dubai: End of Service Pay Calculation

In the private sector, employment contracts include a legally defined benefit at the end of service that is designed to protect employees’ finances when their employment ends. This benefit is often referred to by the term gratuity. When employees are resigning or facing termination, switching jobs, or reviewing job offers, they usually seek clarity on the topic. It is important to have a clear understanding of gratuity because even minor misunderstandings may lead to incorrect expectations or settlement disputes.

Employees are often confused by the different contract structures and rules for partial service years. Knowledge of the rules allows employees to calculate their entitlements correctly, prepare necessary documentation, and communicate with confidence with employers. This topic is important for those who are in long-term employment, or professionals nearing a career change, as well as individuals comparing pay packages.

Gratuity Calculator Dubai : End of Service Understanding

Labor regulations that apply to the private sector govern end-of-service benefit payments. These regulations define eligibility rules, service length rules, and the salary components that are used to calculate benefits. The law guarantees that employees who have completed a minimum period of service will receive fair compensation.

Calculation of gratuity is based on the basic salary only. Excluded are allowances like housing, transportation, overtime, commissions and bonuses. This rule ensures that calculations are consistent and does not include inflated figures.

After completing a full year of service, a gratuity is payable. Paid leave approved by the employer is counted towards service length, while unpaid leaves may reduce total service time. The employer is legally required to calculate this amount and pay it within a reasonable period of time following the termination of employment.

Who is eligible for gratuity payments?

The eligibility of a person depends on two factors: the length of their service and how they terminated employment. To qualify, employees must have completed a continuous minimum of one year.

The following are eligible for:

- Full-time private-sector employees

- Contract holders of unlimited and limited contracts

- Employees who resign after the minimum service period

- Termination of employees without cause

Employees who are terminated due to serious misconduct in violation of labor laws may lose their rights. Contracts shorter than a year do not qualify for eligibility unless specifically stated in the contract.

The Impact of Contract Types

Fixed-term agreements and open-ended contracts are the two main types of employment contracts. The contract type has a major impact on the gratuity payable in resignation situations.

Resigning from a fixed-term contract before the contract is completed may result in a reduction or elimination of entitlements, depending on the service length and clauses within the contract. Even if an employee resigns, open-ended contracts allow for the accrual of gratuities after the minimum service requirements are met.

The contract language is crucial. To avoid surprises during the final settlement, employees should review carefully clauses relating to early termination, notification periods, and benefits.

Basic Salary: Its role in calculation

The calculation of gratuity is based on the salary stated in the employment contract. It is one of the most misunderstood parts of the process.

Included in the exclusions are:

- Housing Allowance

- Transportation allowance

- Overtime Payments

- Performance Bonuses

- Sales commissions

If an employee earns a large total package, including multiple allowances, gratuity will be calculated on only the base salary. This distinction can cause confusion and disagreements when expectations are based upon gross income.

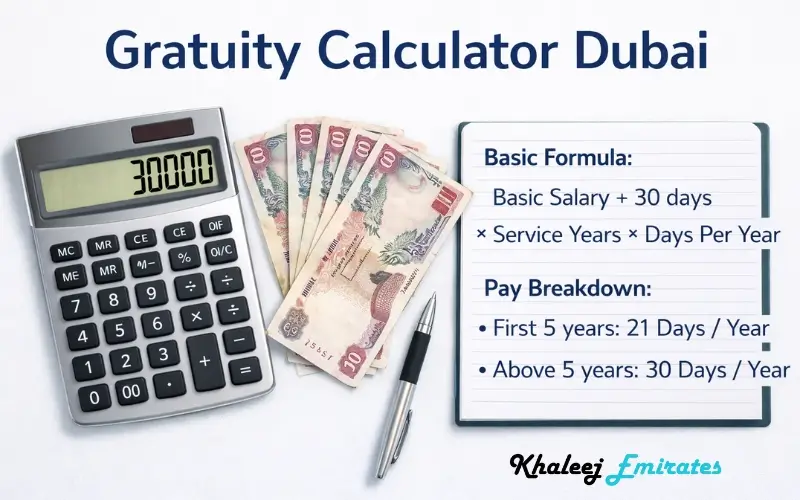

The Standard Gratuity Calculation Rules

Calculate gratuity using your last basic salary drawn and the total number of years you have completed. The formula is based on a three-tiered structure.

First five years: 21 Days of Basic Salary per Year

After five years, 30 days basic salary per annum

Total gratuity can’t exceed 2 years of basic pay

Calculation of partial years is proportional. The total amount is increased proportionally if an employee has completed six months more after a year.

Gratuity Calculation Chart

| Years of Service | Days per Year | Calculation Basis |

| Ages 1-5 | 21 Days | Basic Salary |

| Above 5 Years | 30 Days | Basic Salary |

| Maximum limit | 24 Months | Basic Salary |

This table shows how the service duration affects final entitlement.

Calculation Example

Consider the following example:

- Basic Salary: 6,000

- Service duration: 7 years

Calculation:

First five years:

6,000/30 x 21 x 5, = 21,000

The remaining 2 years:

6,000/30 x 30 x 2, = 12,000

Total Gratuity: 33,000

This example illustrates how the entitlement increases after five years of service.

Differences between Resignation and Termination

The reason why employment ended is a key factor in determining how much you will receive.

Considerations for resignation

- Contract Type

- Service length

- Proper notice compliance

Employees who quit early can receive reduced benefits depending on their service length and contract terms.

Termination considerations

- Employer justification

- Respect for labor laws

- Absence from serious misconduct

In general, termination without fault results in full entitlement.

Common mistakes that employees make

Due to incorrect assumptions, many employees are misinformed about gratuity. These mistakes often cause disputes or disappointments during the final settlement.

Some common mistakes include:

- Use total salary instead

- Negating unpaid leave has a negative impact

- Overlooking resignation penalties

- Instant payment is not acceptable

By avoiding these mistakes, you can ensure a smoother process of settlement.

Documents Required for Settlement

To finalize the payment of gratuity, employers usually require certain documents. All relevant documents should be kept by employees.

Documents commonly required:

- Employment Contract

- Salary Certificate

- Letter of resignation or termination

- Final Settlement Statement

- Identification documents

Documentation helps to avoid delays and disputes.

Digital tools and accuracy of calculations

To estimate their entitlement, many employees use online tools like a gratuity calculator, gratuity calculator uae or gratuity calculator dubai. These tools can be used to quickly calculate based on basic salary and service years.

The results are only estimates. Online tools don’t account for contract-specific provisions, unpaid leave adjustment, or exceptional situations. The employer must verify the final figures.

Special Cases and Industry Variations

Some organizations offer benefits at the end of service that are above and beyond the minimum legal requirements. Some organizations, such as multinational corporations, free-zone entities and senior executive contracts, offer enhanced benefits.

Included in this category are:

- Transfers between group companies

- Mergers and acquisitions

- Changes in the salary structure during employment

- Unpaid leave approved by the employer

Every case must be carefully reviewed for employment history and contract conditions.

Employer obligations and payment timelines

Employers have a legal obligation to calculate and pay the gratuity within a reasonable time after employment has ended. Payments are usually included with the final settlement, along with any pending salaries and unutilized leave compensation.

Unjustified delays may result in formal complaints. Communication between HR and employees is often the key to resolving issues.

Dispute Resolution Options

Employees should contact HR first if they have any disagreements. If the dispute is not resolved, formal complaints may be filed with labor authorities.

The majority of disputes are caused by misunderstandings in calculations, not intentional withholding. Documentation that is accurate usually results in a quick resolution.

Read Also: Al Ansari Balance Check

Financial Planning and the Use of Gratuity

A gratuity is often a large lump-sum payment. Planning helps maximize the value of a gratuity over time.

Some common uses include:

- Savings for emergencies

- Repayment of debt

- Career transition support

- Education or skill development

Planning ahead will prevent you from making rash decisions about your finances.

Regional Employment Context

The employment regulations are the same in all major business centers, such as Dubai and Abu Dhabi. Although administrative processes can vary, employee rights rules and gratuity policies remain the same.

Final Summary

Benefits at the end of service are an important part of financial security for employees. Employees can plan and protect their rights with confidence if they have a clear understanding of the eligibility rules, salary structure and calculation rules. Knowing how contract terms and service duration affect outcomes can help employees avoid mistakes and achieve fair settlements.

Read Also: FEWA Bill Check

FAQs

Gratuity is calculated on the gross salary or the basic salary.

The gratuity is calculated based on the salary drawn at the time of calculation.

Unpaid leave can affect the entitlement to gratuity.

Unpaid leave can reduce the total length of service used to calculate your salary.

Can you pay gratuity in installments

The payment is made in a single lump sum, unless the parties agree to something else.

What happens if the salary changes while you are working?

Calculation is based on the last basic salary drawn.

Does the gratuity apply to part-time workers?

The eligibility depends on the contract classification and the labor regulations.

Employers can refuse to pay gratuity.

Payment is only required in cases of misconduct that can be legally justified; otherwise, it’s mandatory.